digital bills company Paytm expects to start its bills bank operation in the usa by means of August.

The Noida-founded enterprise had received an in-precept approval from RBI to set up a paymentsfinancial institution in August closing 12 months.

payments financial institution can be given demand deposits and financial savings bank deposits frompeople and small organizations, up to a most of Rs. 1 lakh per account.

“we hope to finish all the necessities and hand them to RBI for their cross–ahead via August… via then,we can also have a brick and mortar set-up in region,” Paytm co-founder and CEO Vijay Shekhar Sharmainformed reporters in New Delhi.

but, the focus may be on using generation and connecting the unbanked and underbanked populace, heintroduced.

“we are able to begin with north east and crucial as we stated during the licence system,” he said.

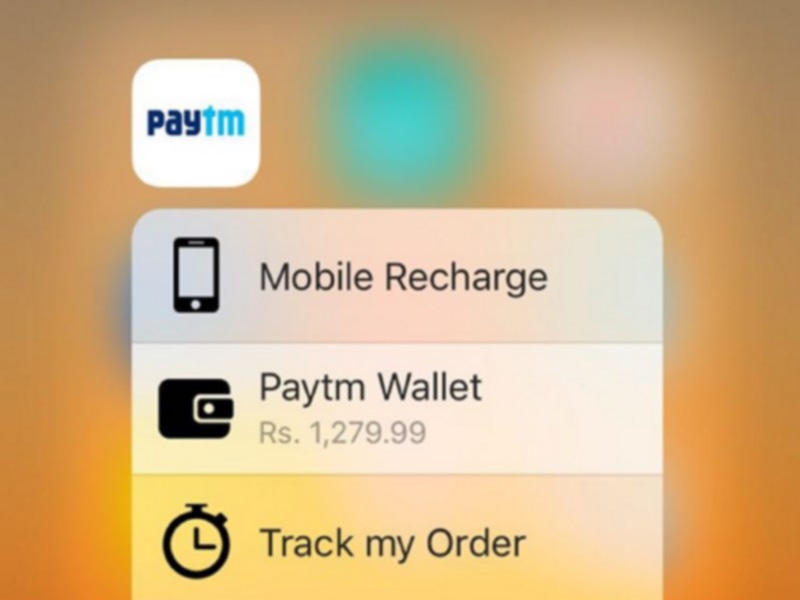

post the launch of the bank, Paytm will become an cease-to-end charge economic services firm with banking and cellular wallet services. It also has an e-trade platform as well as helps digital price of recharge and software bill fee.

“one of the things we’re doing is introducing playing cards with QR codes, which will permit userswithout smartphones to transact,” Sharma said.

according to reviews, Paytm has partnered Wipro to create the needful generation infrastructure for thebills bank business.

Disclosure: Paytm founder Vijay Shekhar Sharma’s One97 is an investor in gadgets 360.

download the devices 360 app for Android and iOS to stay up to date with the contemporary techinformation, product reviews, and specific deals at the popular mobiles.

Tags: Apps, E trade, India, internet, on line Wallets, Paytm, Vijay Shekhar Sharma