A majority of mWallet users agree with that safety of their mobile wallets is under danger from use of social networking and e-commerce apps, a Norton via Symantec examine said Tuesday.

in line with the Norton cell Survey, fifty two percentage respondents see chance coming from the use ofapps together with those from social networking (27 percentage), online buying (24 percentage) and messaging (19 percentage), among others.

“The most concerning safety issues for Indian cellular customers are virus/malware assaults (34 in step with cent), followed by way of threats involving fraudulent get right of entry to or misuse of credit card orfinancial institution account information (21 percentage) and hacking or leaking of personal information(19 percentage),” Norton with the aid of Symantec’s us of a manager, India, Ritesh Chopra said.

Globally, out of the ten.eight million apps analysed via Symantec’s Norton mobile Insights in 2015, nearlythree.three million had been labeled as malware, a 230 percentage growth from 2014.

One in 3 customers is aware that many apps they use are likely to gather facts about them. but, one infive stated he would download any app that “regarded cool”, irrespective of its origin or recognition, theobserve said.

approximately 36 percent disclosed that they might either constantly grant permission or in reality do notrecognise sufficient about the sort of consent they may have granted.

“most effective eight percent reject requests bearing in mind the dangers involved. further, Indianconsumers have granted permission to access contacts, phone information, digicam and location for afree app,” Chopra stated.

“purchasers in India are trading their non-public data in trade of free mobile apps, exposing themselves toprivateness risks.”

The look at was performed amongst 1,1/2 Indian telephone and pill customers elderly 16 years and above.

curiously, on a mean, customers discovered it safe to keep over Rs. 19,000 of their mWallet money owed. The Norton study revealed that two out of three Indians (65 percentage) now access the internetmore frequently on a mobile tool than on a non-public pc.

while 4 out of five (eighty one percent) customers concede that security dangers on cellular gadgetsare simply as tremendous as computer systems or laptops, a majority (nearly 60 percent) of them seemto be undermining the security of their gadgets by way of dismissing those risks as pretty minimum, Chopra stated.

“cell devices… are virtual warehouses storing our most personal moments and data inclusive of snap shots and motion pictures, conversations with pals and own family, fitness and health facts, financialrecords etc,” Chopra stated.

but, maximum clients unknowingly placed personal records on their mobile phones at danger and compromise privateness, he brought.

He advised that they need to use strong passwords, be vigilant and overview settings and updatesregularly, aside from using cell protection answers.

down load the gadgets 360 app for Android and iOS to live up to date with the present day techinformation, product critiques, and distinct offers at the popular mobiles.

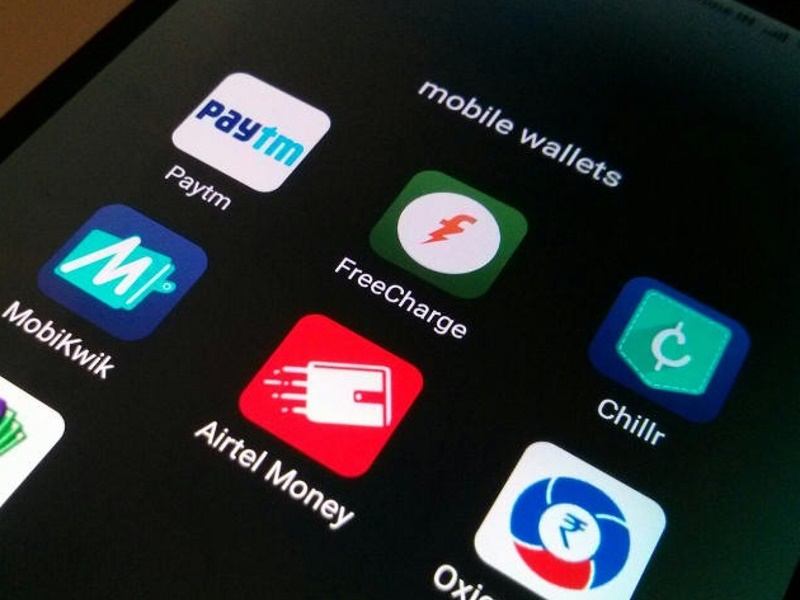

Tags: Apps, Freecharge, India, Malware, cell payments, cell Wallets, mWallets, Norton, on-line bills,payments Banks, Paytm, Symantec, Virus