Summary

BUZ is the first fund to attempt to use social media analytics to invest in stocks. The theory is that AI can lead to deep analysis of finance on social.

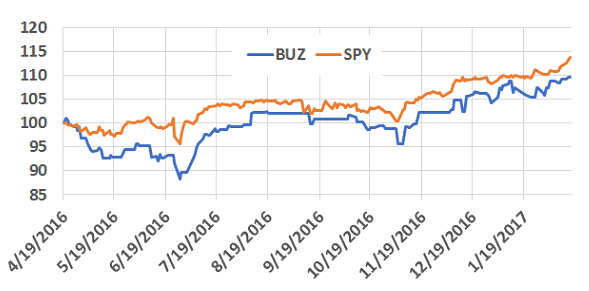

After almost a year live, BUZ has underperformed a passive index of large cap stocks, the SPDR S&P 500 Trust ETF.

The ETF is reconstituted monthly, and at the very least, one can get a list of the “hot stocks” added to the fund each month.

Two stocks, GM and CSCO, appear to be the best stocks from the BUZ list of incoming stocks. Both have fairly high dividends, lots of cash flow and good technicals.

The Sprott BUZZ Social Media Insights ETF (NYSEARCA:BUZ) is the first fund to attempt to use social media analytics to invest in stocks. The theory is that natural language processing and artificial intelligence can lead to deep analysis of finance related discussion on social media platforms. The big question is ” Can sentiment be measured in a predictive manner?“

Sprott believes that it can, and launched BUZ in April 2016, with the expectation of providing investors with superior returns. The problem is that after almost one year live, BUZ has underperformed a passive index of large cap stocks, the SPDR S&P 500 Trust ETF (NYSEARCA:SPY).

Patience is warranted however, as 10 months is not a lot of time for an ETF to prove its worth. While waiting for this alpha-generating strategy to show some results, why not take advantage of this product for individual stock selections? The ETF is reconstituted monthly, and at the very least, one can get a list of the “hot stocks” added to the fund each month. These stocks may not produce a profit, but they are hot, you can be sure that the price will move one way or the other. With a bit of extra work, investors may be able to separate the potential winners from the dogs.

[“source-ndtv”]

Steve Auger

Steve Auger